CUSTOMER Q&A: Carvana

Reimagining big-ticket checkouts

Carvana uses instant bank payments to streamline the car buying experience.

Goal

Enable instant payments, enhance customer experience

Region

United States

Industry

Automotive

Transforming car buying with instant payments

Carvana has transformed the way people buy cars—making it possible to browse, finance, and purchase a vehicle entirely online. To bring that same level of innovation to the payment experience, Carvana partnered with Plaid to enable both instant payments and instant refunds. The result: a faster, more intuitive checkout that meets customer expectations and reinforces trust at every step.

In this conversation, Brian Dammeir, Head of Payments and Financial Management at Plaid, spoke with Matt Dundas, Vice President of Finance at Carvana, about eliminating friction, building trust, and bringing the company’s mission of a fun, fast, and fair car-buying experience to life.

Dammeir: Carvana has been at the forefront of reimagining the car buying experience from end to end. Can you share how your work with Plaid supports that mission—across payments and beyond?

Dundas: From the beginning, Carvana’s goal has been to make car buying as easy and as seamless as any other online purchase. That means removing friction at every step, from browsing and financing to pickup or delivery. Our work with Plaid unlocks a faster, more seamless checkout experience by enabling real-time payments at a critical step in the process. It’s a natural extension of our broader mission: making the car-buying experience fun, fast, and fair.

Dammeir: What led Carvana to adopt real-time payment rails (e.g., Request for Payment via RTP), and how do they enhance the customer experience?

Dundas: As pioneers in automotive ecommerce, the Carvana team is committed to making every part of the car-buying experience easier for our customers. This includes adopting innovative payment solutions. Traditional e-commerce runs on credit and debit cards, but in automotive, the large average transaction sizes can carry high processing costs and payment size constraints that don’t always align with our customers’ needs. ACH payments are compatible with large transaction sizes, but lack the speed and certainty of a credit or debit card payment. Plaid’s new real-time payment rails bridge that gap, combining the real-time, always-on nature of credit or debit cards with the scalability and cost effectiveness of ACH. Adopting RTP allows Carvana to deliver a more seamless, modern, and trusted payment experience that aligns with the expectations of our customers and the future of online car buying.

"Our work with Plaid unlocks a faster, more seamless checkout experience by enabling real-time payments at a critical step in the process. It’s a natural extension of our broader mission: making the car-buying experience fun, fast, and fair."

Vice President of Finance, Carvana

Dammeir: Carvana also offers instant payouts (refunds) through Plaid. What have been the primary benefits—both for customers and operations—of that instant-payout setup?

Dundas: Refunds are a part of any retail experience, but how quickly they’re handled makes all the difference. With Plaid’s instant payout capabilities, for eligible transactions, we’re able to issue refunds right away, giving customers immediate resolution and reinforcing trust in the process.

Dammeir: How does Carvana build trust with customers—especially around payments and credit checks—and how do Plaid’s tools support those goals?

Dundas: Trust is foundational in e-commerce, especially when a customer is making such a significant purchase. From our transparent pricing and 7-day Money Back Guarantee, to the way we handle payments and credit checks, we’re always working to give customers more control and confidence. Plaid’s approach to consent and authentication supports that effort by allowing us to create a seamless payment experience without ever compromising on privacy or transparency.

Dammeir: Looking ahead, what’s next for Carvana in terms of reshaping the car buying experience?

Dundas: We’re always focused on what makes the experience better for the customer. As we continue to scale, we’re investing in the systems and tools that make the process better, more intuitive, more transparent, faster, and more on the customer’s terms.

Dammeir: Do you have any words of wisdom to share with other companies modernizing their payments and underwriting processes?

Dundas: Keep the customer at the center. It’s easy to get excited about the technology, but the real value comes from making things simpler, faster, or more trustworthy for the end user. If you start there, the right technology decisions tend to follow.

Dammeir: What made Plaid the right partner to help you enable real-time payments?

Dundas: We’ve worked with Plaid for years, and they’ve been a strong partner in simplifying complex financial interactions. Real-time payments aren’t just about speed; they’re about delivering a smoother, more intuitive checkout experience. Plaid helps remove barriers at a critical moment in the purchase flow, and that kind of orchestration makes the process feel effortless, just like we believe car buying should be.

Read more about Plaid and Carvana's work together here.

More customer stories

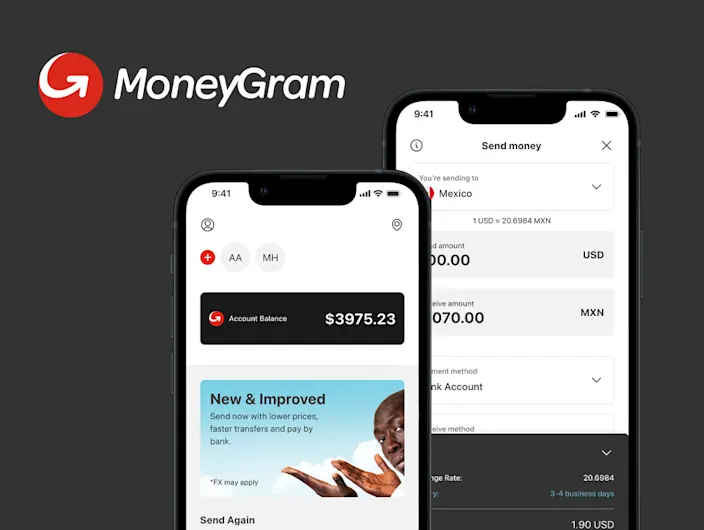

How MoneyGram is reshaping cross-border payments

Read storySmarter credit for startups to enterprises

Read story

The rise of pay by bank with Adyen

Read story